Introduction

Bayer Crop Science Statistics: If you’ve been following the agri-tech space, you’ve heard about Bayer Crop Science. In this article, I’m breaking down Bayer Crop Science Statistics from the ground up, covering everything from its origin, revenue, and global reach to product strategy, R&D, and future projections.

You won’t find vague numbers here, I promise. So, if you’re looking to truly understand Bayer Crop Science Statistics, you’re in the right place. Let’s break it down.

Editor’s Choice

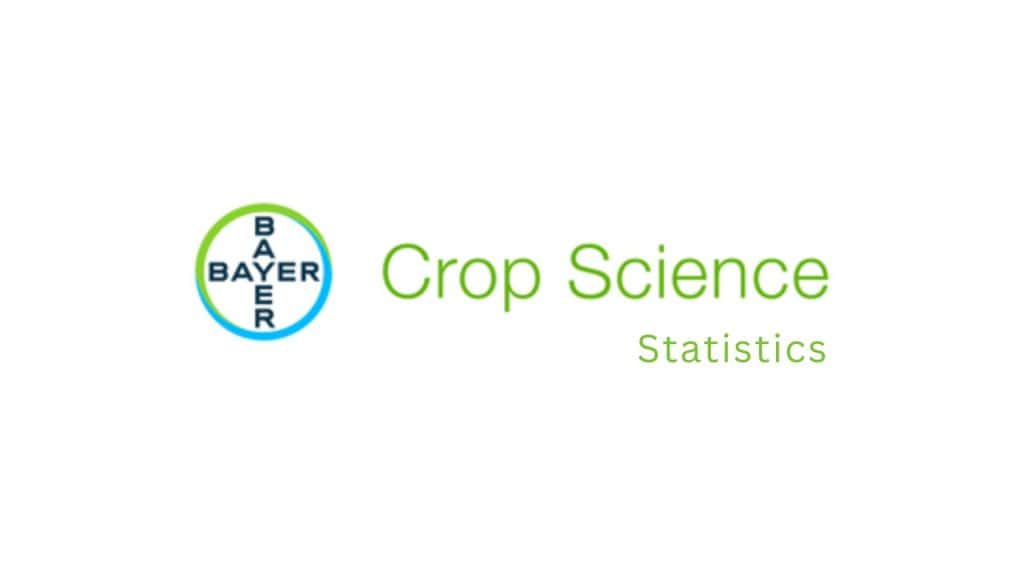

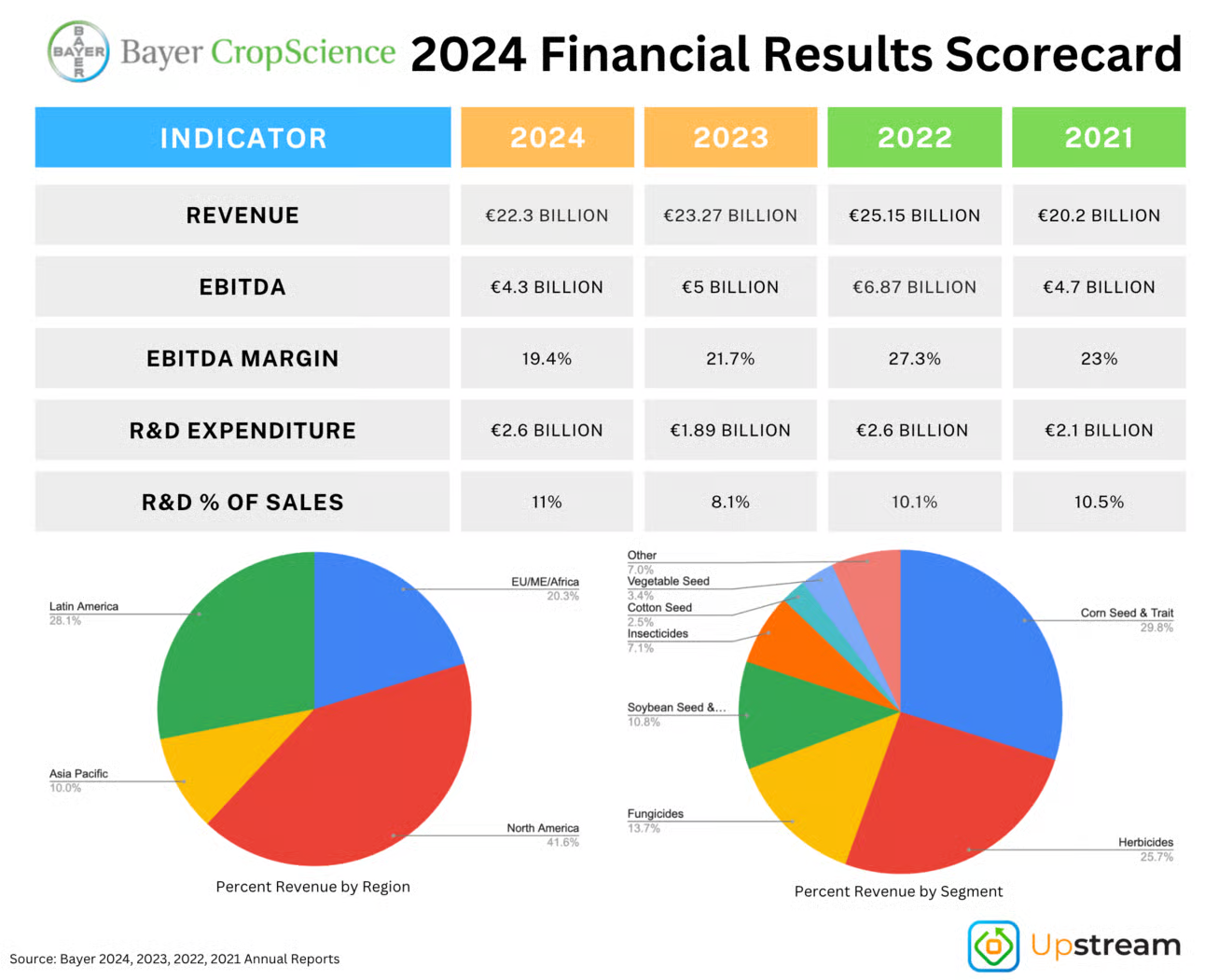

- Founded in 2002 via Bayer’s acquisition of Aventis CropScience, revenue grew from €6B early to €25.2B in 2022, then fell to €23.3B in 2023 and €22.3B in 2024; accounts for 48 to 49% of Bayer’s €46.6B total sales.

- 2024 EBITDA before special items €4.3B (margin 19.4%, down 2.3pts); net loss €2.6B; free cash flow €3.1B.

- Q1 2025 regional growth: North America to 6.1% reported ( to 8.2% fx‑adj), Latin America 11.9% ( to 0.9% fx), EMEA +0.7% (+1.7% fx), Asia‑Pacific +10% (+9.6% fx); regional mix 37% North America, 28% EMEA, 28% Asia‑Pacific, 7% LatAm/Africa.

- Seeds & traits 30 to 40% of CropScience revenue; Intacta2 Xtend soybean seeds cover 30% of Brazil soy area; pipeline 150 ag products with 30 expected by 2026.

- Crop protection volume down 4% in 2024; glyphosate prices fell 13% despite 7% volume growth; Bayer market share 9 to 10% of global crop protection ($75B by 2025); Asia‑Pacific 36 to 37%.

- R&D investment €5.4B in 2024 (10% of revenue); CropScience R&D down 1.4% in Q1 2025; 150 projects in pipeline, 30 launching by 2026; focus on seeds, digital tools, sustainability.

- Acquired Monsanto ($63B) in 2018, inheriting Roundup liabilities; 2024 impairments €3.8B; legal reserves €10 to 16B; 67,000 lawsuits pending; share price down 60% since acquisition.

- 2024 peer comparison: Bayer revenue €22.3B, EBITDA €4.3B(19.4% margin); Syngenta €17B rev, €2.3B EBITDA; Corteva $17B rev, €3.4B EBITDA.

- Strategic changes: exiting U.S. seed‑treatment business in 2025; closing German herbicide plants by 2028 (700 jobs); 7,000 global layoffs since mid‑2023; focus shifting to digital farming and innovation.

- 2025 outlook: sales guidance to 1% to 3% (fx‑adjusted), EBITDA margin 18 to 20%; recovery from 2026; mid‑20s % margin target by 2029; aim to lower net debt/EBITDA to 2.5×; litigation resolution critical.

| Category | Details |

| Origin & Formation |

Formed in 2002 after acquiring Aventis CropScience; major Monsanto acquisition in 2018 (€63B) |

|

Revenue Trend |

2022: €25.2B → 2023: €23.3B → 2024: €22.3B; contributes 48 to 49% of Bayer’s total revenue |

| EBITDA & Profitability |

2024 EBITDA before special items: €4.3B (19.4% margin); net loss: €2.6B |

|

Cash Flow |

Free cash flow in 2024: €3.1B |

| Regional Sales Split |

NA: 37%, EMEA: 28%, Asia-Pacific: 28%, LatAm/Africa: 7% |

|

Q1 2025 Growth (FX adj) |

NA: to 8.2%, LatAm: to 0.9%, EMEA: +1.7%, Asia-Pac: +9.6% |

| Product Focus |

Seeds & Traits: 30 to 40% of CropScience rev; 150 products in pipeline; 30 to launch by 2026 |

|

Glyphosate Market |

Prices dropped 13%, volume up 7%; Bayer has 9 to 10% of $75B global market |

| R&D Spending |

€5.4B total in 2024; CropScience R&D down 1.4% in Q1 2025; deep focus on innovation |

|

Legal & Liabilities |

Roundup legal cases pending: 67,000; €10 to 16B reserve; 2024 impairment: €3.8B |

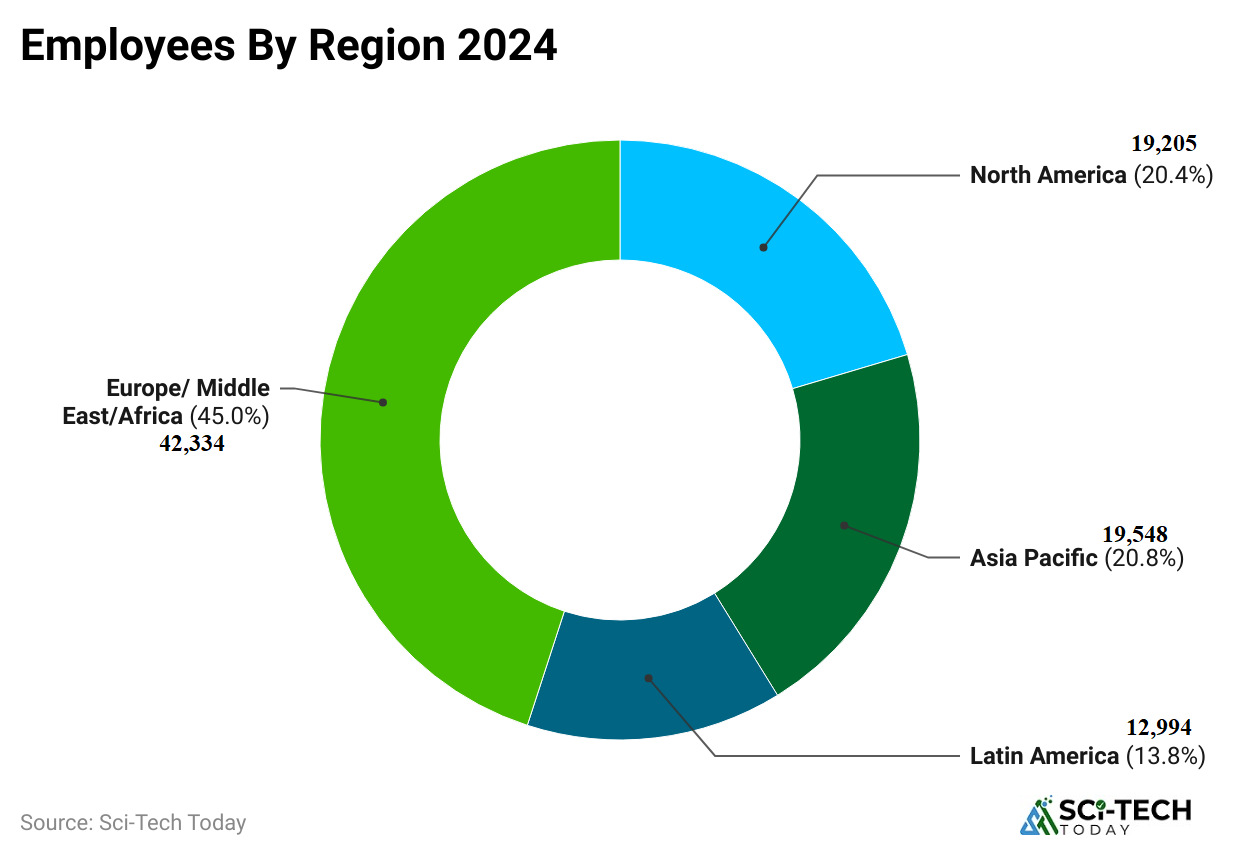

| Headcount & Restructuring |

7,000 layoffs since 2023; plant closures planned in Germany by 2028 |

|

Digital Farming Push |

Transitioning towards digital ag-tech platforms and sustainable innovation |

| Peer Comparison (2024) |

Bayer: €22.3B rev / €4.3B EBITDA; Corteva: $17B / $3.4B EBITDA; Syngenta: €17B / €2.3B |

|

2025 Outlook |

Expected sales drop to 1% to 3%; margin target: 18 to 20% in 2025, 25% by 2029 |

Origins and Revenue Evolution

- Bayer CropScience was launched in 2002, following Bayer’s acquisition of Aventis CropScience, with initial sales of €6 billion.

- By 2022, revenue had grown to around €25.2 billion, indicating long‑term expansion.

- In 2023, CropScience revenue declined to €23.3 billion, a drop of roughly 4 to 5%.

- Full‑year 2024 revenue came in at €22.3 billion, down about 2.0% year‑over‑year.

- CropScience consistently represents 48‑49% of Bayer Group sales volume.

- Bayer’s total sales in 2024 were €46.6 billion, with CropScience at €22.3 billion.

- Revenue peak occurred in 2022, then declined through 2024 with pricing pressure.

- CAGR from the early 2000s to 2022 was approximately 10% annually.

- 2025 guidance expects CropScience sales to fall 1 to 3%, currency‑adjusted.

- EBITDA margins are forecast to stay in the 18 to 20% range in 2025.

| Year | CropScience Revenue (EUR bn) | YoY % Change |

| 2022 | 25.2 | to |

| 2023 | 23.3 | to 4.3% |

| 2024 | 22.3 | to 2.0% |

Profitability and Cash Flow

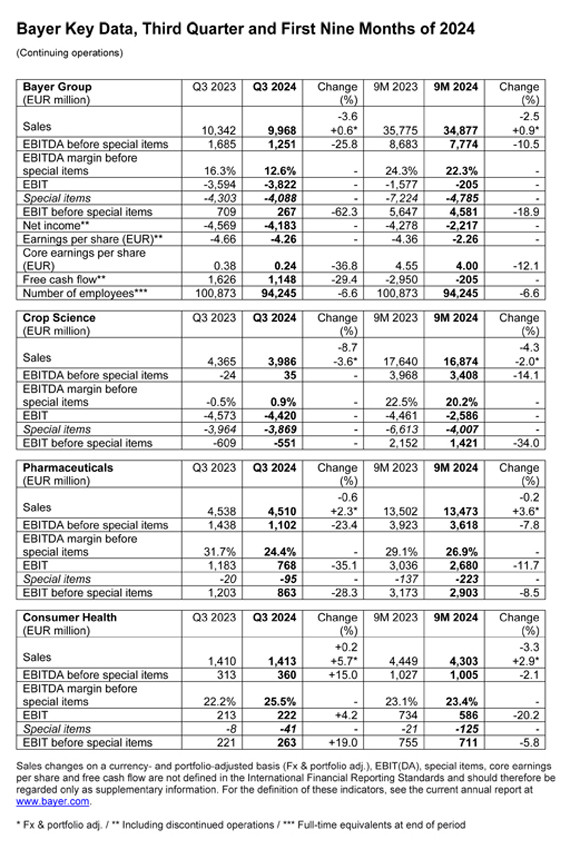

(Source: upstream.ag)

(Source: upstream.ag)

- In 2024, CropScience EBITDA before special items was €4.3 billion, down 14.2%.

- EBITDA margin declined to 19.4% in 2024, losing about 2.3 points.

- Free cash flow for Bayer in 2024 was €3.1 billion, slightly above targets.

- Bayer’s overall adjusted EBITDA fell to €10.1 billion in 2024.

- Core earnings per share in 2024 were €5.05, down from the prior year.

- Full‑year net income for Bayer was a €2.6 billion loss, led by impairments.

- Q3 2024 EBIDTA (adjusted) dropped 26% to €1.25 billion vs the prior quarter.

- CropScience impairment charges in 2024 totaled €3.8 billion.

- Q1 2025 EBITDA margin remains forecast at 18 to 20%, with weak demand.

- Management expects improvements starting in 2026 with margins back to mid-20s by 2029.

| Metric | 2024 Value |

| EBITDA (pre‑special items) | €4.3 bn |

| EBITDA margin | 19.4% |

| Free cash flow | €3.1 bn |

| Net income | to €2.6 bn |

Regional Performance

(Reference: bayer.com)

(Reference: bayer.com)

- North America was modestly resilient in 2024, though still slightly down.

- Latin America declined sharply due to weaker planting areas and prices.

- EMEA (Europe/Middle East/Africa) saw flat to slight growth late‑2024.

- Asia‑Pacific delivered double‑digit regional growth in early 2025.

- In Q1 2025, North America revenue fell 6% reported and 8% FX-adj.

- Latin America fell 12% reported, but only 1% fx‑adjusted decline.

- EMEA grew 0.7% reported / 1.7% fx‑adjusted in Q1 2025.

- Asia‑Pacific grew 10% reported / 9.6% fx‑adjusted in Q1 2025.

- Regional revenue mix: North America 37%, EMEA 28%, Asia‑Pacific 28%, LatAm/Africa 7%.

- Latin America remains the most volatile region due to planting timing.

| Region | Reported Change | Fx‑Adjusted Change |

| North America | to 6.1% | to 8.2% |

| Latin America | to 11.9% | to 0.9% |

| EMEA | +0.7% | +1.7% |

| Asia‑Pacific | +10.0% | +9.6% |

Seeds and Traits

(Source: upstream.ag)

(Source: upstream.ag)

- Bayer owns Seminis and Intacta2 Xtend soybean traits, significant in Brazil.

- Intacta2 Xtend seed adoption in Brazil rose to about 30% of soy area in 2024‑25.

- Seeds & traits volumes were flat to slightly down in 2024 due to planting reduction.

- Seed revenues are estimated at 30 to 40% of CropScience’s total sales.

- The development pipeline includes 150 ag products, 30 expected by 2026.

- Next‑gen Intacta2 pipeline aims to tackle pest resistance in soy.

- Brazil remains the core market for seed trait volume growth.

- Regulations (dicamba) in U.S. seed traits weigh on U.S. corn volumes.

- Latin America’s planted area trends significantly influence seed sales.

- Bayer targets smallholder farmers to reach expansion via seed innovations.

| Metric | Approximate Value |

| Brazil soy Intacta2 Xtend share | 30% of the soy area |

| Seed share of CropScience | 30 to 40% |

| Pipeline products by 2026 | 30 out of 150 |

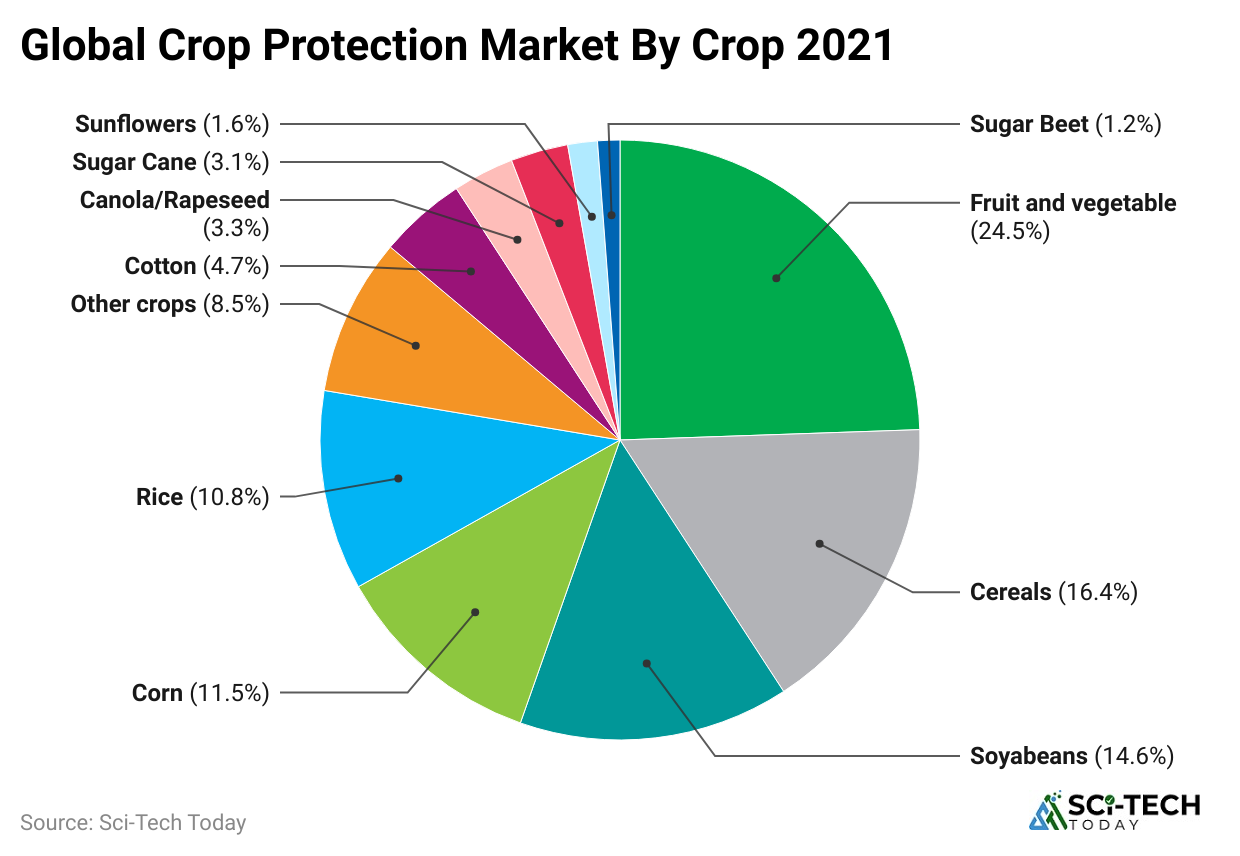

Crop Protection Trends

(Reference: spglobal.com)

(Reference: spglobal.com)

- Crop protection volumes slipped 4% in 2024 due to pricing pressure.

- Glyphosate pricing dropped 13% in 2024 despite a 7% volume increase.

- Glyphosate sales remain a major crop protection sub‑segment.

- Glyphosate pricing drop hurt revenue despite volume gains.

- Bayer holds a 9 to 10% share of the global crop protection market.

- The global crop protection market is projected to $75 billion by 2025.

- Asia‑Pacific region is expected to cover 36 to 37% of that market.

- Bayer continues to face competition from generic manufacturers.

- Generic herbicide pricing pressure is toughest in Latin America.

- Crop protection decline continues to affect CropScience’s profitability.

| Metric | Value |

| Crop protection sales change (2024) | to 4% |

| Glyphosate price drop in 2024 | 13% |

| Bayer’s global market share | 9 to 10% |

| Global market size by 2025 | $75 bn |

| APAC share of the global market | 36 to 37% |

R&D Investment and Pipeline

(Source: bayer.com)

(Source: bayer.com)

- Total R&D spend in 2024 was approximately €2.4 to 2.6 billion in the CropScience segment.

- Bayer invested about 10% of group revenue (€5.4 billion) across divisions.

- CropScience R&D spend down 1.4% in Q1 2025 versus the prior year.

- There are 150 agricultural projects in development overall.

- Roughly 30 of those are expected to reach the market by 2026.

- R&D focus includes next‑gen seeds, digital tools, and herbicide tolerance.

- Bayer integrates ESG sustainability targets into the R&D pipeline.

- Digital farming tools are being rolled out globally to farmers.

- Seed and trait innovation in the pipeline is key to revenue recovery.

- R&D efforts are aligned to bolster margins beyond 2025.

| Metric | Statistic |

| Group R&D spend (2024) | €5.4 bn (10% rev) |

| CropScience R&D change (Q1 2025) | to 1.4% |

| Projects in a pipeline | 150 |

| Expected launches by 2026 | 30 |

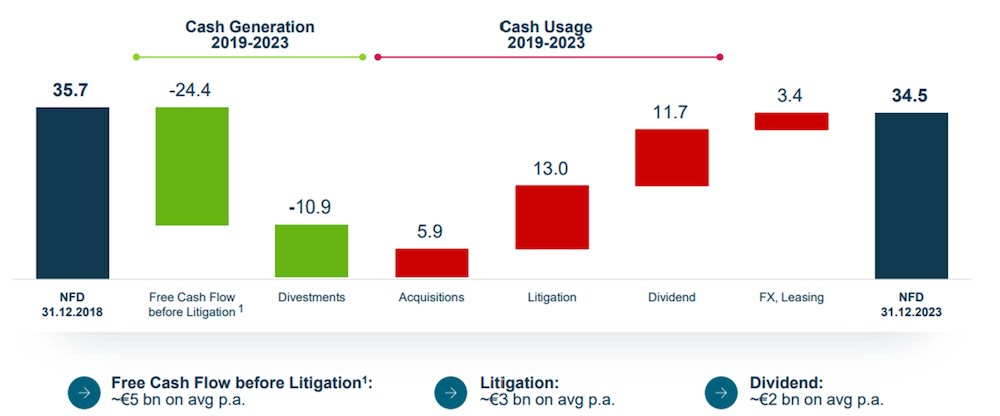

Litigation and Impairment Impact

(Source: planet-tracker.org)

(Source: planet-tracker.org)

- Bayer acquired Monsanto in 2018 for $63 billion, inheriting Roundup legal risk.

- CropScience impairment charges in 2024 totaled €3.8 billion.

- Net loss for Bayer in 2024 was €2.6 billion, driven by those impairments.

- Roundup litigation provisions weighed heavily in Q3 and full‑year results.

- EBITDA impact from litigation caused a quarterly loss of €4.2 billion.

- Provisions continue into 2025, pressuring EBITDA margins and cash flow.

- Bayer has reserved €10‑16 billion for settlements and legal costs.

- Share price dropped 60% since the Monsanto acquisition, largely litigation‑related.

- Without liability protections, Bayer may eventually exit glyphosate products.

- CEO efforts include lobbying and cost cuts to rebuild financial resilience.

| Item | Value / Estimate |

| 2024 CropScience impairments | €3.8 bn |

| 2024 net loss | €2.6 bn |

| Legal reserves estimate | €10 to 16 bn |

Peers and Competitive Position

- In 2024, Bayer CropScience’s revenue €22.3 bn vs Syngenta $17 bn, and Corteva $17 bn.

- Bayer CropScience EBITDA €4.3 bn, higher than many peers’ below‑€3 bn.

- Bayer’s EBITDA margin (19.4%) in 2024 matched or exceeded Syngenta and BASF.

- Corteva reported relatively stable results with modest margin declines.

- BASF’s ag‑solutions revenue in 2024 was under €10 bn.

- Bayer retains top global ranking when combining seeds + crop protection.

- Bayer’s share of the global agrochemical market is 9 to 10%.

- Bayer lost more EBITDA % than Corteva but less than Syngenta (YoY).

- Syngenta EBITDA fell 32% YoY vs Bayer’s 14%.

- Bayer’s scale advantages remain notable across both segments.

| Company | Revenue (EUR bn) | EBITDA (EUR bn) | EBITDA Margin (%) |

| Bayer | 22.3 | 4.3 | 19.4% |

| Syngenta | 17.0 (USD 17 billion) | 2.3 | Lower |

| Corteva | 17 billion USD | 3.4 | 20 to 25% |

| BASF | 10 | 1.9 | Similar |

Strategic Moves and Operational Shifts

(Source: bayer.com)

(Source: bayer.com)

- In 2025, Bayer announced an existing U.S. seed treatment equipment business to refocus.

- German herbicide manufacturing sites in Frankfurt and Dormagen will close by 2028.

- These closures affect 700 employees across both sites.

- Resources reallocated toward digital farming and high‑value innovation.

- CropScience restructuring includes 7,000 job cuts globally from mid‑2023.

- CEO plans for cost rationalization and faster decision‑making across units.

- Bayer is repositioning toward strategic tech instead of generic volume manufacturing.

- Restructuring is designed to safeguard profitability in regulated markets.

- Focus narrowed to seed traits and flagship crop protection innovations.

- Operational pivot expected to boost margins beyond 2026.

| Initiative | Key Data Point |

| U.S. seed‑treatment exit | Beginning 2025 |

| German site closures by | End of 2028 |

| Employees affected | 700 total |

| Global job cuts since mid‑2023 | 7,000 |

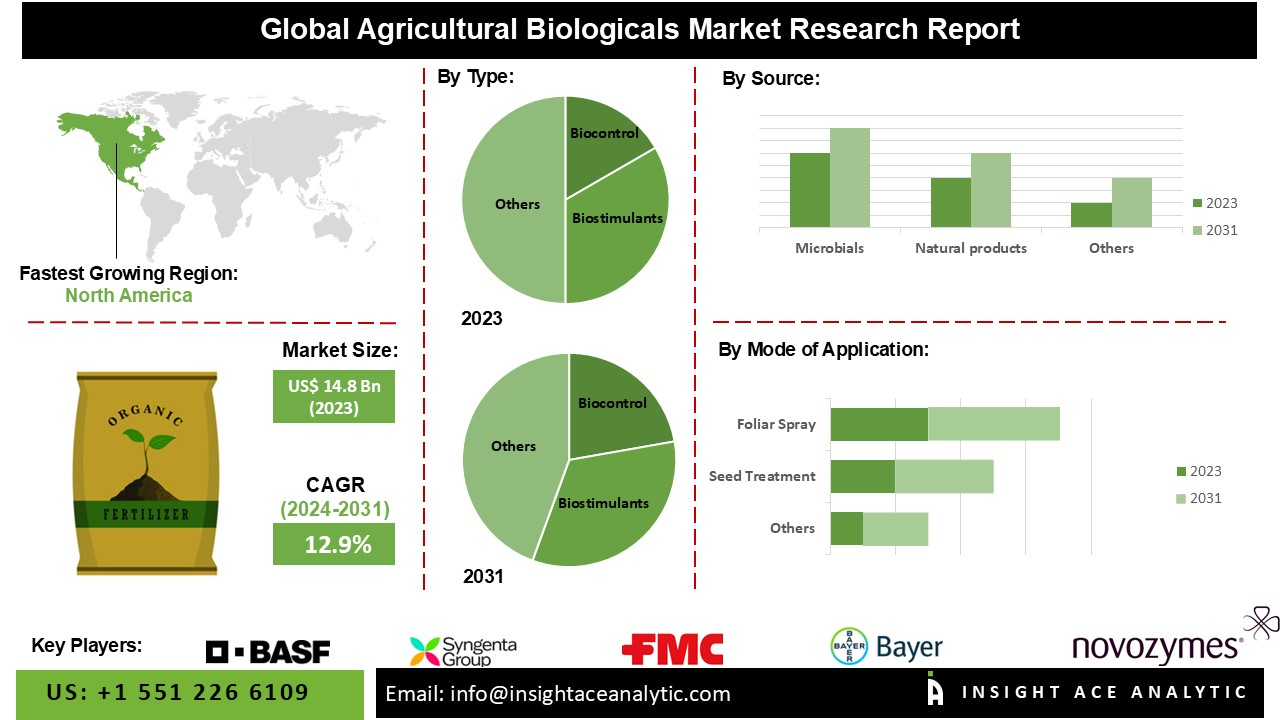

2025 Outlook and Forward Projections

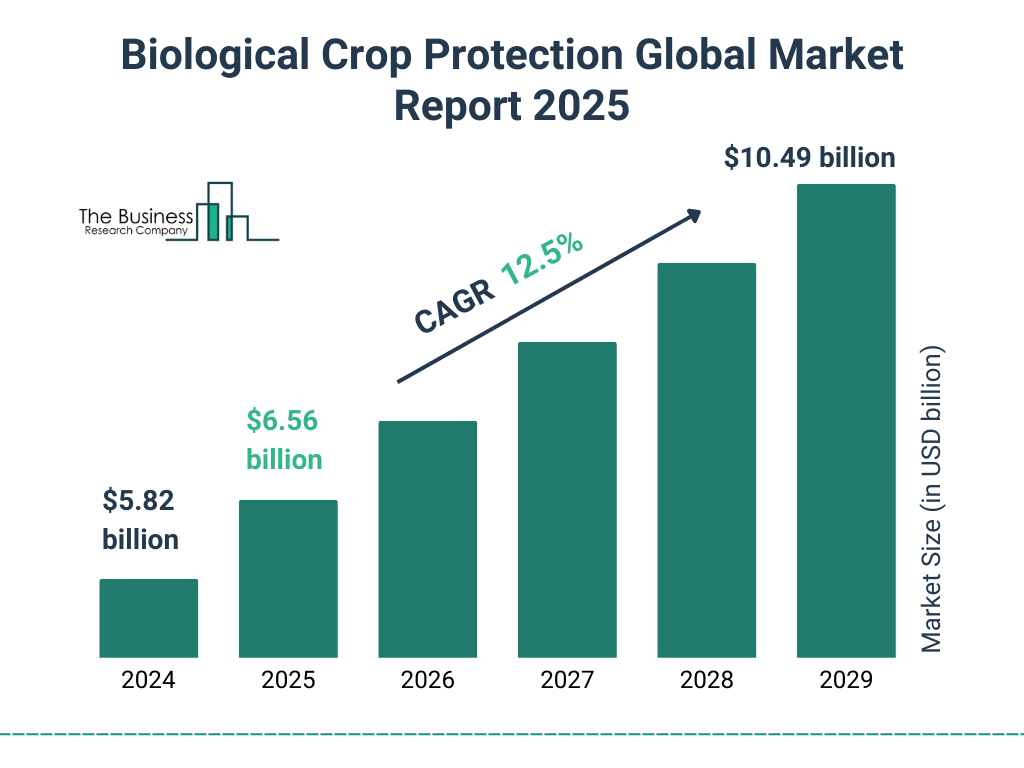

(Source: thebusinessresearchcompany.com)

(Source: thebusinessresearchcompany.com)

- Bayer expects 2025 CropScience sales to decline 1 to 3% (currency‑adjusted).

- EBITDA margin forecast for 2025 remains in the 18 to 20% range.

- Improved performance is anticipated starting in 2026 onward.

- Mid‑2029 margin targets for CropScience are “mid‑twenties” percent.

- Recovery hinges on new product launches and cost discipline.

- Seed trait innovation in Brazil and the Asia‑Pacific is seen as a growth driver.

- Latin America remains volatile; Asia‑Pacific shows consistent strength.

- Global crop protection market growth is expected to be 5.7% CAGR from 2025 to 2033.

- Bayer aims to reduce the net debt/EBITDA ratio to about 2.5× in the coming years.

- Litigation resolution or regulatory relief would significantly improve margins.

| Indicator | Forecast / Target |

| 2025 ag sales growth | to 1% to 3% |

| EBITDA margin (2025) | 18 to 20% |

| 2029 margin target | Mid‑20s% |

| Net debt/EBITDA target | 2.5× |

| Ag market CAGR (2025 to 33) | 5.7% |

Conclusion

So, that’s the complete picture, Bayer Crop Science Statistics, broken down from every possible angle. From where it all began to how it performs today across global markets, revenues, growth, and even legal battles,

In an industry where change is constant, Bayer’s data shows a company that’s deeply invested in long-term growth, sustainability, and digital transformation. Whether you’re a student, investor, or just someone curious about the agri-business world, I hope this breakdown gives you a clear and data-driven understanding of Bayer Crop Science Statistics without drowning you in some random numbers. If you have any questions, kindly let me know in the comments. Thanks.