Introduction

Biopharmaceuticals Statistics: The biopharmaceutical industry is growing quickly and plays a key role in creating advanced medical treatments. Unlike traditional medicines, biopharmaceuticals come from living organisms, making them very effective in treating diseases like cancer, diabetes, and autoimmune disorders.

In 2024, the global biopharmaceutical market is growing fast because of innovations, higher demand for personalized treatments, and more investments in biotechnology. As the industry grows, the focus on biologics, biosimilars, and targeted therapies will change healthcare, giving millions of patients new hope. This article looks at the latest statistics and trends in this fast-changing industry.

Editor’s Choice

- The global biopharmaceutical market will reach USD 304 billion in 2024, showing continued strong growth from last year, resulting in USD 284 billion.

- As of 2024, North America leads the biopharmaceutical sector with a market share of around 40%.

- Europe is expected to grow at a CAGR of 4.8% from 2023 to 2028 due to increasing government investments in the healthcare segment.

- Meanwhile, the top segment of the market will be Monoclonal antibodies, which hold a 42% market share in biopharmaceuticals.

- Biopharmaceuticals Statistics show that companies in the biopharmaceutical sector invest close to 20% of their revenue in research and development.

- In Cancer treatments, oncology therapies will contribute to approximately 33% of the global biopharmaceutical market in 2024.

- The use of personalised biopharmaceuticals is predicted to increase by 10%, especially in targeted cancer therapies.

- The number of biopharmaceutical startups has increased by 15% annually, fostering innovation in new treatments.

- Biopharmaceuticals Statistics further state that the Asia-Pacific region will grow the fastest, with a projected CAGR of 6.5%.

- Moreover, biologics account for 65% of newly approved drugs by the FDA.

General Biopharmaceuticals Statistics

(Source: licdn.com)

(Source: licdn.com)

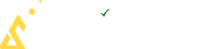

- As of 2023, the biopharmaceutical market had grown to USD 478.20 billion and is estimated to reach USD 961.51 billion by 2032.

- The growth rate of the market will increase at 8.07% CAGR each year from 2023 to 2032.

- Over 60% of global deaths are attributed to chronic diseases such as cancer, diabetes, and cardiovascular diseases.

- New gene therapy treatment for hemophilia is expected by Q3 2024, with an anticipated annual market impact of USD 1 billion.

- According to the WHO 2023 data, 41 million people die from chronic diseases yearly, making up 74% of all deaths worldwide.

- Evidence shows that 17 million people die prematurely from chronic diseases, with 86% occurring in low and middle-income countries.

- Cutting-edge technologies like CRISPR and mRNA platforms have accelerated the development of new treatments, contributing to the rapid growth of the sector.

- Biopharmaceuticals Statistics: In 2023, around 537 million people globally had diabetes, and this is expected to increase to 643 million by 2030 and 783 million by 2045.

- The global population aged 65 and older will increase by 9.5% by the end of 2024, leading to higher demand for biopharmaceuticals.

- By 2040, new cancer cases are estimated to reach 27.5 million, with 16.3 million cancer deaths expected worldwide.

Biopharmaceuticals Statistics By Global Market Size

(Reference: statista.com)

(Reference: statista.com)

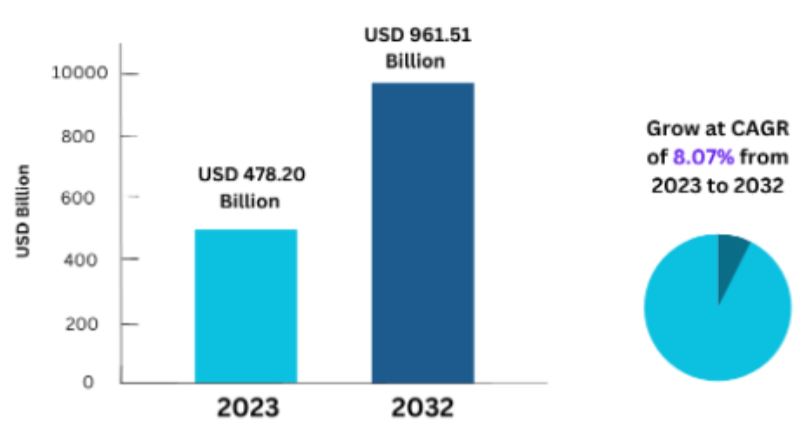

- A Statista report analyses show that the global biopharmaceuticals market was valued at approximately USD 284 billion in 2023 and will grow to USD 304 billion by 2024.

- The projected size of the biopharmaceuticals market worldwide in coming years is estimated as 2025 (USD 336 billion), 2026 (USD 367 billion), 2027 (USD 393 billion), 2028 (USD 413 billion), 2029 (USD 447 billion), 2030 (USD 479 billion), 2031 (USD 518 billion) and 2032 (USD 556 billion).

By Type Market Share

- Monoclonal antibodies are the largest category in biopharma, making up 42% of the market. They are mainly used to treat cancer and autoimmune diseases.

Furthermore, other types and market segmentations are stated below in 2024

| Types | Market Share | Market Value (USD) |

Growth Driver |

| Monoclonal Antibodies (mAbs) | 42% | 127 billion | Rising use in oncology and autoimmune treatments. |

| Vaccines | 18% | 54.7 billion | Continued demand for vaccines, especially for COVID-19 and other infectious diseases. |

| Recombinant Proteins | 25% | 76 billion | Increasing applications in hormone replacement therapies and chronic disease management. |

| Cell and Gene Therapies | 10% | 30.4 billion | Advances in gene editing technologies like CRISPR are fueling growth. |

| Other Biopharmaceuticals | 5% | 15.2 billion | Expanding applications in biosimilars and innovative biologics. |

By Application Share

- Biopharmaceuticals Statistics state that in 2024, oncology (cancer treatment) will lead the U.S. biopharmaceutical market, holding 33% of the global share.

Furthermore, other applications market analyses are represented in the table below, in the same year:

| Applications | Market share | Market valuation (USD) |

| Oncology (Cancer Treatment) | 33% | 100 billion |

| Diabetes | 15% | 45.5 billion |

| Immunology | 12% | 36.5 billion |

| Infectious Diseases | 10% | 30.4 billion |

| Cardiovascular Diseases | 8% | 24.3 billion |

| Neurology | 6% | 18.2 billion |

| Ophthalmology | 5% | 15.2 billion |

| Respiratory Disorders | 4% | 12.1 billion |

| Haematology | 4% | 12.1 billion |

By End User

- As per Biopharmaceuticals Statistics in 2024, hospitals will account for 45% of the global biopharmaceutical market.

- On the other hand, Research institutes hold around 25% of the market, followed by Specialty Clinics (20%) and Pharmaceutical & Biotechnology Companies (8%).

- Besides, only 2% is attributed to other settings, such as home care, where biopharmaceutical treatments are increasingly being administered at home.

- In addition, only 2% of the biopharmaceutical market share is attributed to other settings, such as home care.

Biopharmaceutical Market Share By Region

(Reference: towardshealthcare.com)

(Reference: towardshealthcare.com)

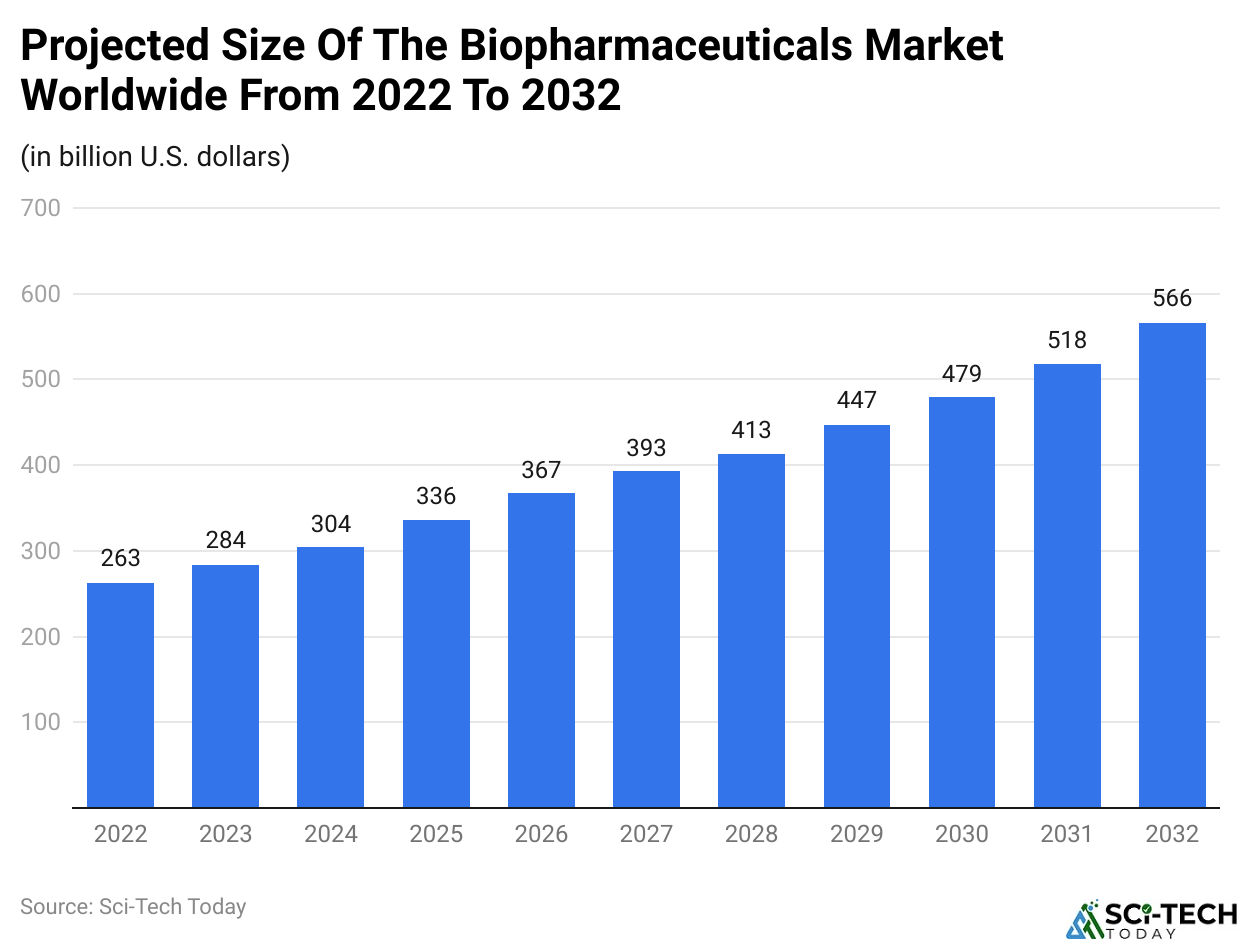

- In 2021, North America led the market with a share of 40.7%, resulting in USD 115.6 billion. By 2030, the market will still dominate, with a share of around 37.5% (USD 200 billion).

Other regional analyses of the biopharmaceutical market are elaborated on below.

| Region | 2021 | 2030 |

| Europe | 28.4% (USD 80.6 billion) | 26.2% (USD 140 billion) |

| Asia-Pacific | 19.6% (USD 55.7 billion) | 26.5% (USD 141 billion) |

| Latin America | 5.4% (USD 15.3 billion) | 5.8% (USD 30 billion) |

| Middle East and Africa | 5.9% (USD 16.7 billion) | 4% (USD 21 billion) |

Top 10 Countries Breakdown of Sales Of New Medicines Launched

- The U.S. leads by a significant margin, driven by its large healthcare market, which has a sales valuation of USD 120 billion and contributes around 40% of the global sales of new medicines.

- Similarly, China is the second-largest market, accounting for 15% of new medicine sales, with a value of USD 45 billion.

Furthermore, the sales analyses by other countries in the same period are represented below:

| Country | Sales Value (USD) |

Sales Share |

| Germany | 25 billion | 8.3% |

| Japan | 24 billion | 8% |

| France | 18 billion | 6% |

| United Kingdom | 15 billion | 5% |

| Italy | 12 billion | 4% |

| Canada | 10 billion | 3.3% |

| South Korea | 9 billion | 3% |

| Spain | 8 billion | 2.6% |

Biopharmaceutical Industry Statistics By Leading Investors, 2024

- Biopharmaceuticals Statistics further show that investment in biopharma is strong, with each round averaging USD 44.5 million in value.

- More than 4,400 investors are supporting over 7,100 companies in the biopharmaceutical sector worldwide.

| Investor’s Name | Investments (USD billion) |

| RA Capital Management | 5.1 |

| ARCH Venture Partners | 3.2 |

| OrbiMed | 2.8 |

| Novartis Venture | 2.4 |

| Ardian | 2.3 |

| Advent International | 2 |

| SoftBank Vision Fund | 2 |

| Bain Capital Life Sciences | 1.7 |

| Redmile Group | 1.7 |

(Source: startus-insights.com)

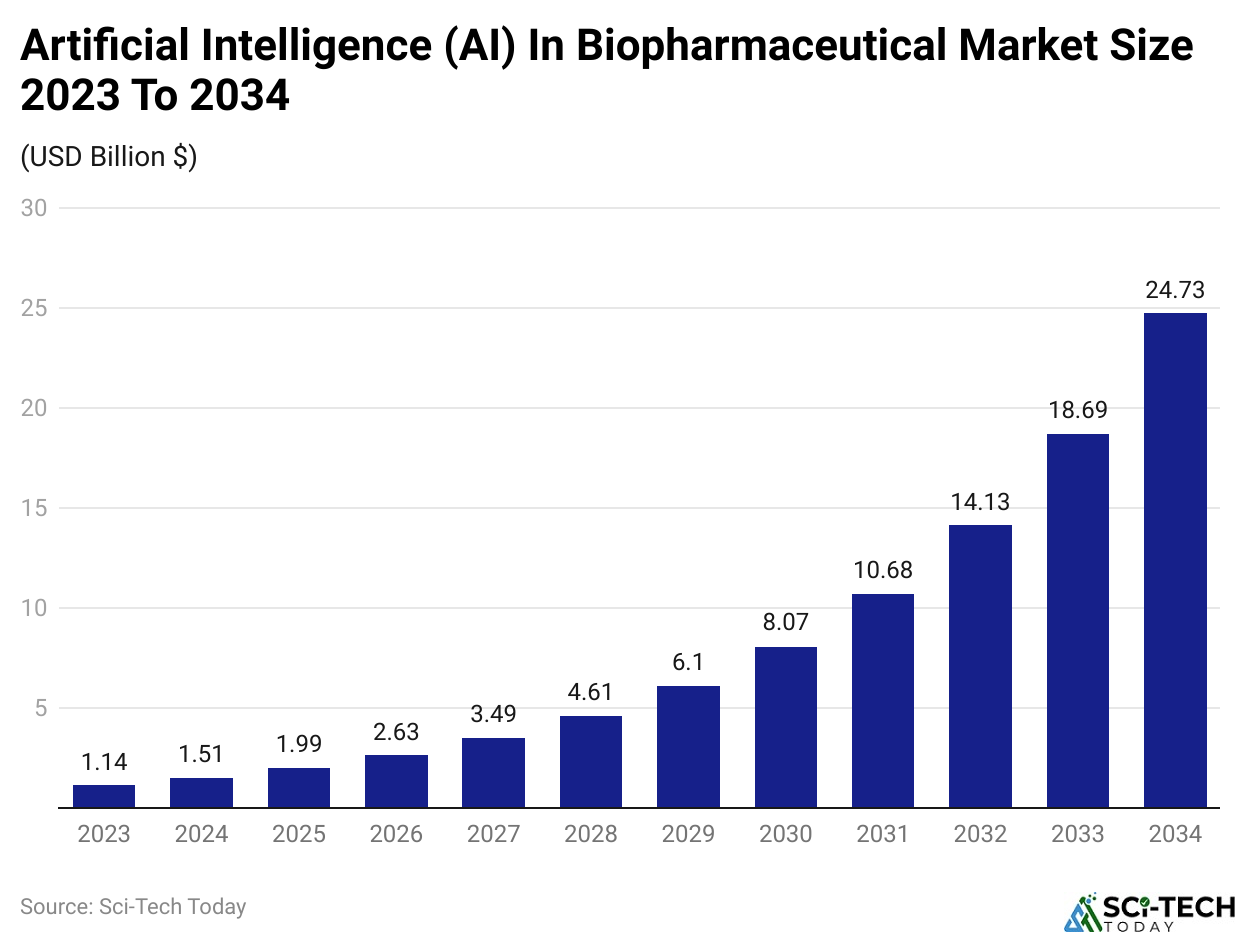

Artificial Intelligence (AI) In the Biopharmaceutical Market Size

(Reference: precedenceresearch.com)

(Reference: precedenceresearch.com)

- Biopharmaceuticals Statistics further states that the global market size for artificial intelligence (AI) in biopharmaceuticals will be worth USD 1.51 billion in 2024.

- The market will grow to about USD 24.73 billion by 2034, with an annual growth rate of 32.25% from 2024 to 2034.

- In 2023, North America made over 46% of the revenue in the artificial intelligence biopharmaceutical market, followed by Asia Pacific (24%), Europe (22%), Latin America (5%), and the Middle East & Africa (3%).

- The U.S. artificial intelligence (AI) market for biopharmaceuticals will be worth USD 475.65 million by the end of 2024.

- Based on application and technology, the drug discovery segment had the biggest market share, at 35%, and the natural language processing segment accounted for 32%, respectively, in 2023.

Top 10 Biopharmaceutical Companies

- Biopharmaceuticals Statistics show that Johnson & Johnson, an American company, will capture the highest market cap, USD 361.95 billion, in 2023.

- In the same duration, the total revenue accounted for by the company will be around USD 85.16 billion.

- They provide new medicines and MedTech solutions in cancer, immunology, brain health, and heart care.

In 2023, other Biopharmaceutical companies’ market analyses were followed:

| Company’s Name | Total Revenue (USD) |

Market Cap (USD) |

| Roche | 69.78 billion | 230.51 billion |

| Merck & Co. | 60.11 billion | 321.01 billion |

| Pfizer | 58.49 billion | 149.04 billion |

| AbbVie | 54.32 billion | 299.29 billion |

| Bayer | 52.58 billion | 29.04 billion |

| Sanofi | 47.54 billion | 118.75 billion |

| AstraZeneca | 45.81 billion | 209.10 billion |

| Novartis | 45.44 billion | 206.26 billion |

| Bristol-Myers Squibb (BMS) | 45.01 billion | 101.93 billion |

(Source: pharmashots.com)

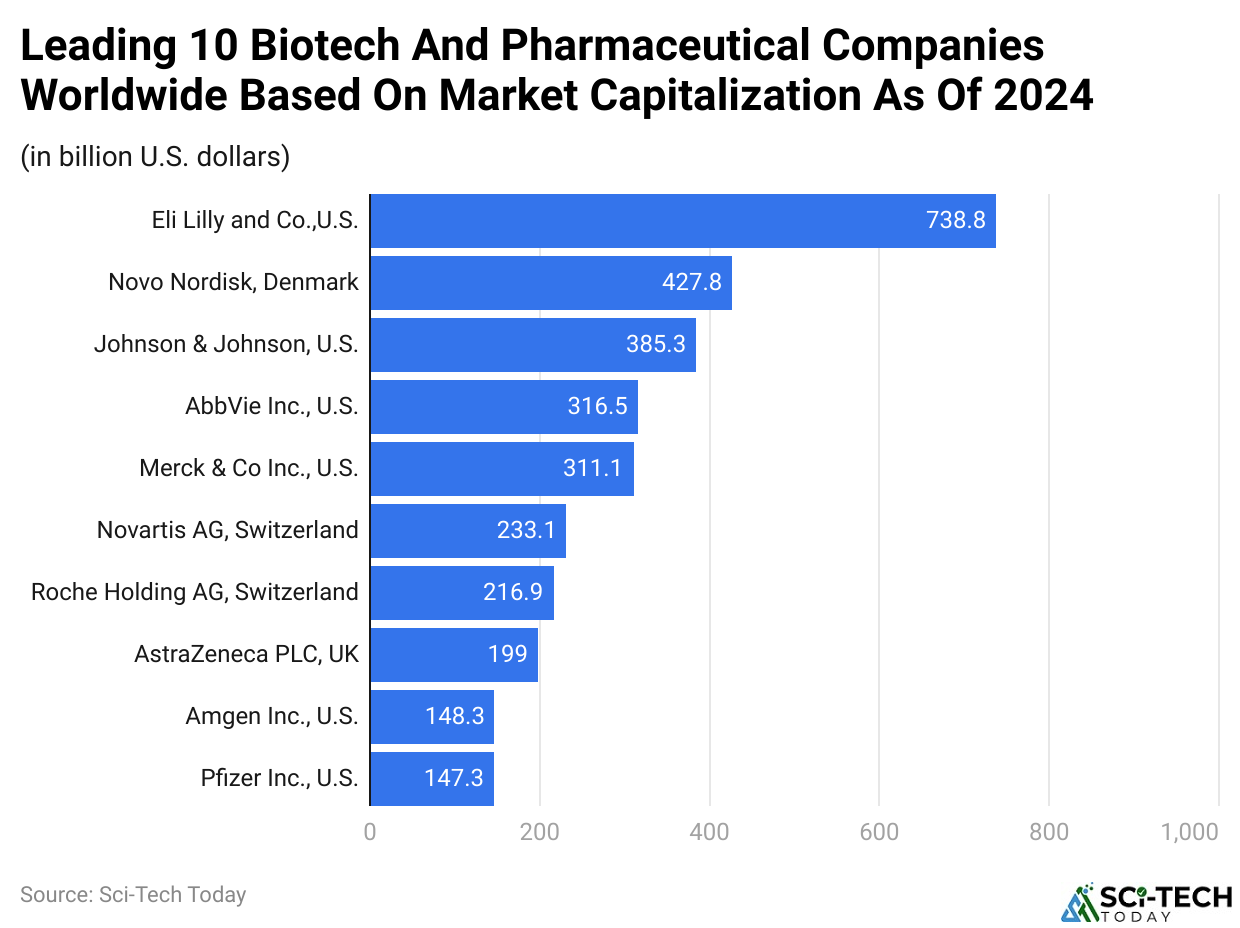

(Reference: statista.com)

(Reference: statista.com)

- In early March 2024, Eli Lilly led big pharma with a market cap of nearly 738.8 billion dollars.

- Furthermore, other leading biotech and pharmaceutical companies worldwide based on market capitalization were Novo Nordisk, Denmark (USD 427.8 billion), Johnson & Johnson (USD 385.3 billion), AbbVie Inc. (USD 316.5 billion), Merck & Co Inc. (USD 311.1 billion), Novartis AG (USD 233.1 billion), Roche Holding AG (USD 216.9 billion), AstraZeneca PLC (USD 199 billion), Amgen Inc. (USD 148.3 billion) and Pfizer Inc. (USD 147.3 billion).

By Company Product Development Updates

| Launch Date | Company’s Product | Used for Treatment |

|

Q3, 2024

|

Amgen: Biosimilar (3) | Cardiovascular |

| Johnson & Johnson: (Gene Therapy) | Hemophilia | |

| Q4, 2024 | Pfizer: (mRNA Vaccine Extension) | Universal Flu Vaccine |

|

Late, 2024

|

Eli Lilly: (Mounjaro) | Alzheimer’s |

| Roche: (Policy) | Personalised Oncology Therapies | |

| Novartis: (Kesimpta) | Multiple Sclerosis Therapy | |

| Merck: (Checkpoint Inhibitors) | Immunotherapies |

Top Biopharmaceutical Innovations And Trends Using The Discovery Platform

- Biopharmaceuticals Statistics in 2024 state that Gene therapy is a growing trend in the biopharma industry, with 2,508 companies working in this field.

- These companies have more than 341,700 employees.

- Meanwhile, the annual growth rate for gene therapy is 0.16% from last year.

- The synthetic biology industry has 1,215 companies and employs 49,000 people. The market’s growth rate will be 9.27% in 2024.

- Drug discovery and development are major trends in the biopharma industry, with 1,289 companies focused on this area.

- The yearly growth rate of 4.98% shows that this sector is steadily growing.

Conclusion

In today’s time, the biopharmaceutical industry is growing fast due to new drug developments, higher demand for treatments for chronic diseases, and more money being invested in biotechnology. North America, Europe, and the Asia-Pacific are the main regions leading the market, and they are expected to keep growing in the coming years.

These biopharmaceutical statistics show a strong focus on biologics, biosimilars, and personalized medicine, and the industry will still rank top in solving the world’s biggest healthcare problems. Looking ahead, the industry’s dedication to new ideas and investment in research and development will continue to shape the future of medicine, offering hope to patients around the

world.